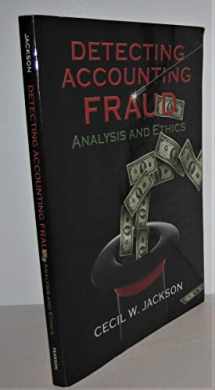

Detecting Accounting Fraud: Analysis and Ethics

Book details

Summary

Description

For courses in Accounting Fraud, Forensic Accounting, Financial Statement Fraud, Financial Statement Analysis, Ethics for Accountants, and Auditing.

A case-study approach that enables students to identify key signs of fraud in financial statements

Over the last two decades, financial statement fraud has become an increasingly serious issue, resulting in the collapse of ostensibly solid companies and a subsequent lack of confidence in financial markets. Detecting Accounting Fraud: Analysis and Ethics was created in response to the challenges facing accountants in this era.

The text provides students a thorough overview of the most frequently used methods of overstating earnings and assets or understating debt in financial statements. It also provides detailed coverage of the main signals indicating possible fictitious reporting in financial statements to help students learn what to look for. And because breakdowns in ethics underlie accounting fraud, the text presents three major theories of ethics, plus applicable ethical decision-making models as well as opportunities for students to apply ethical models to real-world situations.

This text provides a better teaching and learning experience–for you and your students. It will help you to:

• Explain accounting fraud through detailed case studies: The text’s real-world case study approach helps students understand the methods used to perpetrate financial statement fraud today.• Focus student attention on ethics: Ethics coverage integrated throughout the text helps students understand this topic’s importance vis-à-vis accounting fraud.

• Foster thorough understanding via student-focused features: An engaging, captivating writing style and diverse end-of-chapter materials motivate and assist students.¿

We would LOVE it if you could help us and other readers by reviewing the book

Book review